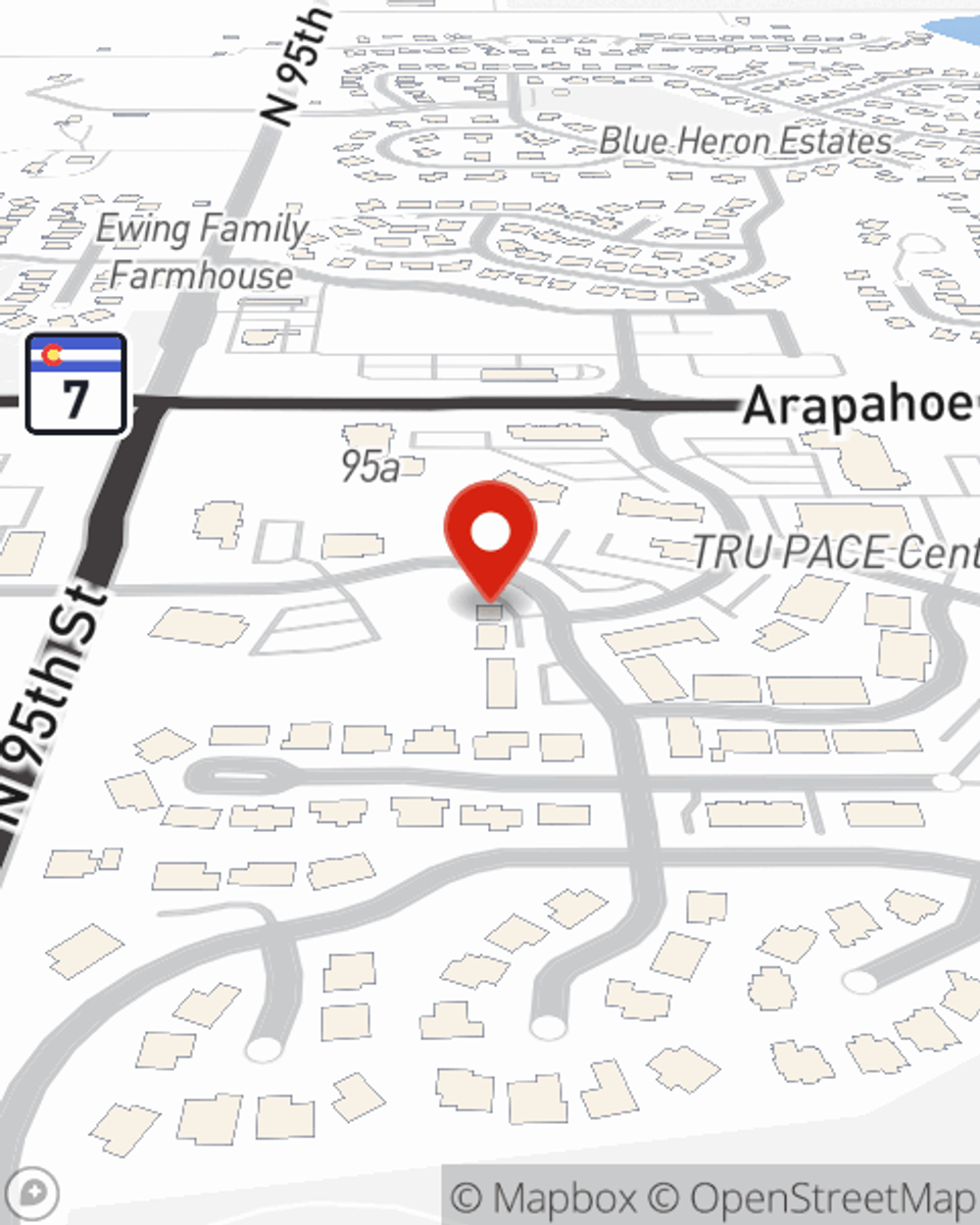

Business Insurance in and around Lafayette

One of Lafayette’s top choices for small business insurance.

This small business insurance is not risky

- Wheat Ridge

- Littleton

- Westminster

- Centennial

- Aurora

- Broomfield

- Englewood

- Lone Tree

- Commerce City

- Cherry Hills Village

- Brighton

- Lafayette

- Indian Hills

- Superior

- Lakewood

- Golden

- Thornton

- Louisville

Coverage With State Farm Can Help Your Small Business.

When experiencing the challenges of small business ownership, let State Farm take one thing off your plate and help provide quality insurance for your business. Your policy can include options such as errors and omissions liability, business continuity plans, and a surety or fidelity bond.

One of Lafayette’s top choices for small business insurance.

This small business insurance is not risky

Customizable Coverage For Your Business

Whether you own an ice cream shop, a home cleaning service or a beauty salon, State Farm is here to help. Aside from excellent service all around, you can personalize a policy to fit your business's specific needs. It's no wonder other business owners choose State Farm for their business insurance.

Agent Isaac Sotelo is here to discuss your business insurance options with you. Visit with Isaac Sotelo today!

Simple Insights®

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.

Isaac Sotelo

State Farm® Insurance AgentSimple Insights®

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.